2+ /

Years of experience

5+ /

National Hackathon Win's

10+ /

AI Projects Deployed

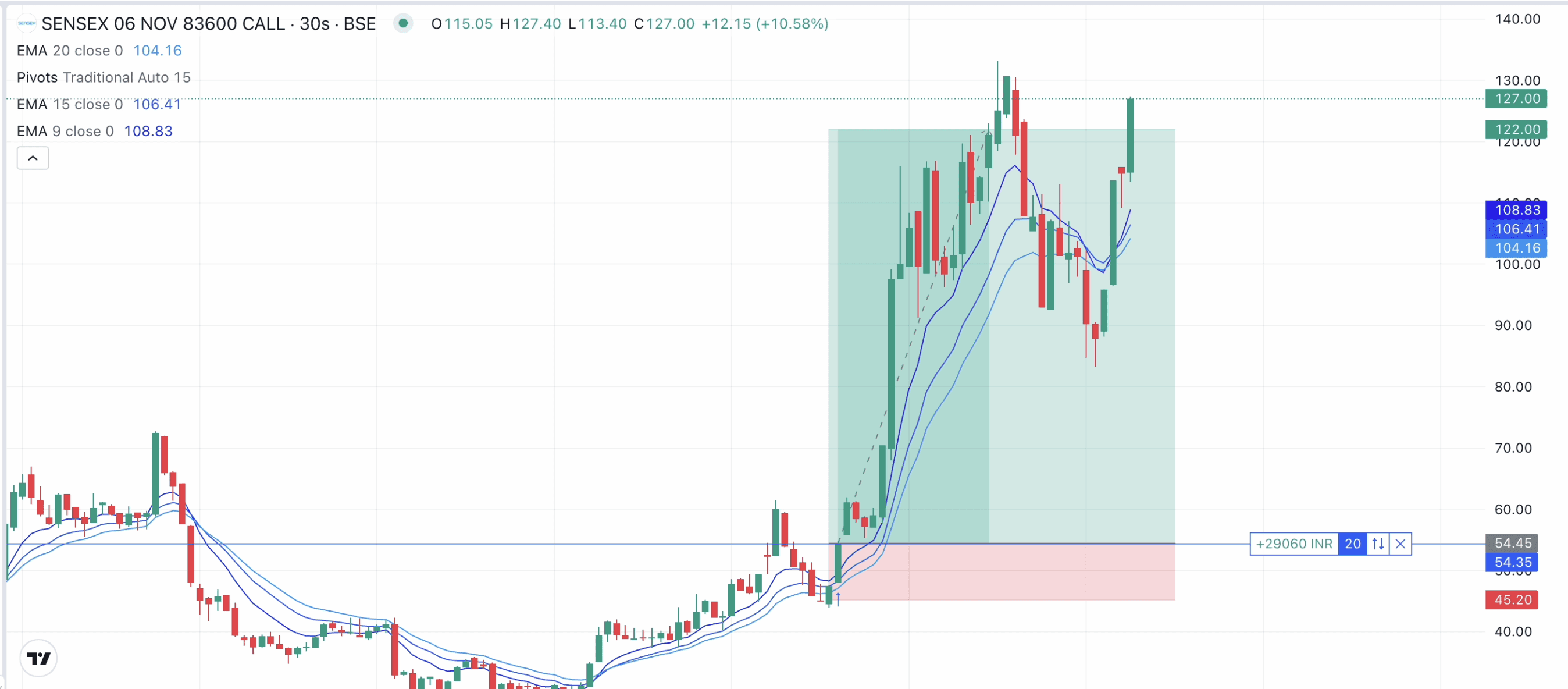

1x/2x/3x

Trading Retruns

2+ /

Years of experience

5+ /

National Hackathon Win's

10+ /

AI Projects Deployed

1x/2x/3x

Trading Retruns

{02} — Tools & Skills

My creative toolbox

{02} — Tools & Skills

My creative toolbox

{02} — Tools & Skills

My creative toolbox

Programming

Python | C++ | SQL/MySQL | Solidity | DSA

90

%

Programming

Python | C++ | SQL/MySQL | Solidity | DSA

90

%

Programming:

Python | C++ | SQL/MySQL | Solidity | Data Structures & Algorithms | OS

90

%

DevOps

GCP | AWS | Kubernetes | Docker | Firebase (Firestore) | BigQuery

90

%

DevOps

GCP | AWS | Kubernetes | Docker | Firebase (Firestore) | BigQuery

90

%

Machine Learning & AI

RAG | MCP | LLM | Computer Vision (OpenCV, OCR, Tesseract, TrOCR) | AI Chat- bots | Seaborn | Langchain | HuggingFace | Rest API | Postman | ADK | Streamlit

90

%

HFT & Systems

HFT | Market Microstructure | Derivatives Pricing | Statistical Arbitrage | Risk Metrics (Sharpe/- Sortino) | Portfolio Risk Management | Multi-asset Trading | Algorithmic Strategy Design

90

%

HFT & Systems

HFT | Market Microstructure | Derivatives Pricing | Statistical Arbitrage | Risk Metrics (Sharpe/- Sortino) | Portfolio Risk Management | Multi-asset Trading | Algorithmic Strategy Design

90

%

DevOps

GCP | AWS | Kubernetes | Docker | Firebase (Firestore) | BigQuery

90

%

Machine Learning & AI

RAG | MCP | LLM | Computer Vision (OpenCV, OCR, Tesseract, TrOCR) | AI Chat- bots | Seaborn | Langchain | HuggingFace | Rest API | Postman | ADK | Streamlit

90

%

Machine Learning & AI

RAG | MCP | LLM | Computer Vision (OpenCV, OCR, Tesseract, TrOCR) | AI Chat- bots | Seaborn | Langchain | HuggingFace | Rest API | Postman | ADK | Streamlit

90

%

Quant & Systems

HFT | Market Microstructure | Derivatives Pricing | Statistical Arbitrage | Risk Metrics (Sharpe/- Sortino) | Portfolio Risk Management | Multi-asset Trading | Algorithmic Strategy Design

90

%

Quant & Systems

HFT | Market Microstructure | Derivatives Pricing | Statistical Arbitrage | Risk Metrics (Sharpe/- Sortino) | Portfolio Risk Management | Multi-asset Trading | Algorithmic Strategy Design

90

%

Quant Trading

BlockChain / WEB3

Software Engineering

Business analyst & VC

AI Developer

AI Developer

Quant Trading

Software Engineering

Business analyst & VC

BlockChain / WEB3

AI Developer

Quant Trading

Software Engineering

Business analyst & VC

BlockChain / WEB3

AI Developer

Quant Trading

Software Engineering

Business analyst & VC

BlockChain / WEB3

{03} — WorkEx

Work Experience

Nov’25 - Dec’26 | New York - USA (Remote)

/

Amazon x Extern

Operational Strategy & Poeple Analytics Data & ML Extern

Cloud-Native NLP Engineering:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

People Analytics & Strategy Insights:

Identified attrition and productivity drivers to support operational decision-making.

ML-Driven Decision Support:

Converted complex data into clear, decision-ready strategy insights.

Nov’25 - Dec’26 | New York - USA (Remote)

/

Amazon x Extern

Operational Strategy & Poeple Analytics Data & ML Extern

Cloud-Native NLP Engineering:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

People Analytics & Strategy Insights:

Identified attrition and productivity drivers to support operational decision-making.

ML-Driven Decision Support:

Converted complex data into clear, decision-ready strategy insights.

Nov’25 - Dec’26 | New York - USA (Remote)

/

Amazon x Extern

Operational Strategy & Poeple Analytics Data & ML Extern

Cloud-Native NLP Engineering:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

People Analytics & Strategy Insights:

Identified attrition and productivity drivers to support operational decision-making.

ML-Driven Decision Support:

Converted complex data into clear, decision-ready strategy insights.

July’25 - Oct’25 | Singapore (Hybrid)

/

Mega Forte

AI Developer Intern

OCR Pipeline Development:

Built an automated OCR system to digitize handwritten answer sheets accurately.

Document Intelligence:

Converted unstructured handwritten data into structured, machine-readable formats.

Evaluation Automation:

Enabled faster and more consistent assessment through AI-driven text extraction.

July’25 - Oct’25 | Singapore (Hybrid)

/

Mega Forte

AI Developer Intern

OCR Pipeline Development:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Document Intelligence:

Identified attrition and productivity drivers to support operational decision-making.

Evaluation Automation:

Converted complex data into clear, decision-ready strategy insights.

July’25 - Oct’25 | Singapore (Hybrid)

/

Mega Forte

AI Developer Intern

OCR Pipeline Development:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Document Intelligence:

Identified attrition and productivity drivers to support operational decision-making.

Evaluation Automation:

Converted complex data into clear, decision-ready strategy insights.

June’25 - Aug’25 | Bangalore - IND, (Hybrid)

/

PipRaiser

Capital Market Analyst Intern

Systematic Trading:

Generated 165.6% returns using macro overlays and order-flow analysis.

Risk Management:

Enforced a strict 5% max risk framework with VaR-based controls.

Multi-Asset Analysis:

Applied cross-asset signals to navigate diverse market regimes.

June’25 - Aug’25 | Bangalore - IND, (Hybrid)

/

PipRaiser

Capital Market Analyst Intern

Systematic Trading:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Risk Management:

Identified attrition and productivity drivers to support operational decision-making.

Multi-Asset Analysis:

Converted complex data into clear, decision-ready strategy insights.

June’25 - Aug’25 | Bangalore - IND, (Hybrid)

/

PipRaiser

Capital Market Analyst Intern

Systematic Trading:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Risk Management:

Identified attrition and productivity drivers to support operational decision-making.

Multi-Asset Analysis:

Converted complex data into clear, decision-ready strategy insights.

Apr’25 - May’25 | Anfa - Casablanca (Remote)

/

Lotus Capital

Quant Trader Trainee

Liquidity Execution:

Deployed institutional liquidity across commodities and FX markets.

Order-Flow Analytics:

Built Python frameworks for order-flow tagging and alpha decay analysis.

Exposure Control:

Maintained disciplined <1.2% risk per position with drawdown control.

Apr’25 - May’25 | Anfa - Casablanca (Remote)

/

Lotus Capital

Quant Trader Trainee

Liquidity Execution:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Order-Flow Analytics:

Identified attrition and productivity drivers to support operational decision-making.

Exposure Control:

Converted complex data into clear, decision-ready strategy insights.

Apr’25 - May’25 | Anfa - Casablanca (Remote)

/

Lotus Capital

Quant Trader Trainee

Liquidity Execution:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Order-Flow Analytics:

Identified attrition and productivity drivers to support operational decision-making.

Exposure Control:

Converted complex data into clear, decision-ready strategy insights.

Aug’24 - Sep’24 | San Fransico - USA (Remote)

/

HP Ventures

Business Analyst & VC Extern

Investment Due Diligence:

Conducted deep diligence on $130M+ Series-A AI investments.

Thesis Modeling:

Built high-conviction investment theses with data-backed valuation models.

Market Analysis:

Analyzed sector trends and sales lift under valuation compression scenarios.

Aug’24 - Sep’24 | San Fransico - USA (Remote)

/

HP Ventures

Business Analyst & VC Extern

Investment Due Diligence:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Thesis Modeling:

Identified attrition and productivity drivers to support operational decision-making.

Market Analysis:

Converted complex data into clear, decision-ready strategy insights.

Aug’24 - Sep’24 | San Fransico - USA (Remote)

/

HP Ventures

Business Analyst & VC Extern

Investment Due Diligence:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Thesis Modeling:

Identified attrition and productivity drivers to support operational decision-making.

Market Analysis:

Converted complex data into clear, decision-ready strategy insights.

Jul’24 - Sep’24 | New York- USA (Remote)

/

HeadStarter AI

Software Engineering Intern

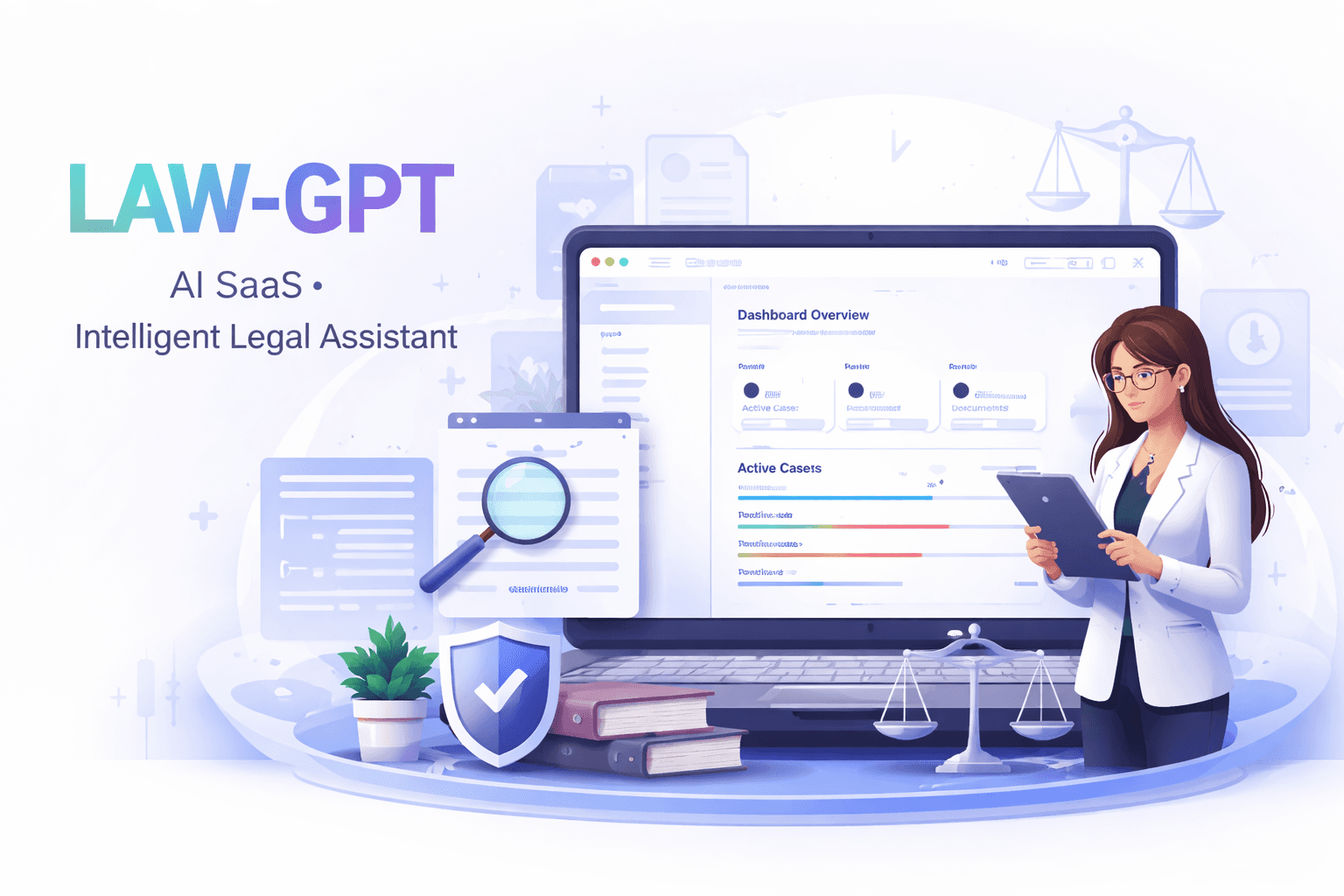

SaaS Architecture:

Helped architect AI-driven SaaS platforms across Fin, Legal, and Ops domains.

Engineering Leadership:

Led a cross-border team delivering production-ready AI systems.

Product Delivery:

Shipped scalable systems aligned with accelerated engineering timelines.

Jul’24 - Sep’24 | New York- USA (Remote)

/

HeadStarter AI

Software Engineering Intern

SaaS Architecture:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Engineering Leadership:

Identified attrition and productivity drivers to support operational decision-making.

Product Delivery:

Converted complex data into clear, decision-ready strategy insights.

Jul’24 - Sep’24 | New York- USA (Remote)

/

HeadStarter AI

Software Engineering Intern

SaaS Architecture:

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Engineering Leadership:

Identified attrition and productivity drivers to support operational decision-making.

Product Delivery:

Converted complex data into clear, decision-ready strategy insights.

May’24 - July’24 | Raipur- IND (Hybrid)

/

IIIT Naya Raipur

AI Developer Research Intern

Transformer Research: Built a T5-based model for multi-class software smell detection.

Built a T5-based model for multi-class software smell detection.

Semantic Modeling:

Leveraged domain-specific semantic alignment to improve precision.

Model Performance:

Achieved strong F1-scores through optimized architecture and evaluation.

May’24 - July’24 | Raipur- IND (Hybrid)

/

IIIT Naya Raipur

AI Developer Research Intern

Transformer Research: Built a T5-based model for multi-class software smell detection.

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Semantic Modeling:

Identified attrition and productivity drivers to support operational decision-making.

Model Performance:

Converted complex data into clear, decision-ready strategy insights.

May’24 - July’24 | Raipur- IND (Hybrid)

/

IIIT Naya Raipur

AI Developer Research Intern

Transformer Research: Built a T5-based model for multi-class software smell detection.

Built NLP pipelines on Google Cloud to analyze large-scale unstructured workforce data.

Semantic Modeling:

Identified attrition and productivity drivers to support operational decision-making.

Model Performance:

Converted complex data into clear, decision-ready strategy insights.

₹4.7L+

2000%+ Returns

Net Alpha Generated Across live options

₹4.7L+

2000%+ Returns

Net Alpha Generated Across live options

₹4.7L+

2000%+ Returns

Net Alpha Generated Across live options

4+

High-Impact Roles

Quant, AI, SDE, WEB3

4+

High-Impact Roles

Quant, AI, SDE, WEB3

4+

High-Impact Roles

Quant, AI, SDE, WEB3

10+

Production Systems Built

Trading, AI SaaS, OCR & Analytics pipelines

10+

Production Systems Built

Trading, AI SaaS, OCR & Analytics pipelines

10+

Production Systems Built

Trading, AI SaaS, OCR & Analytics pipelines

{05} — FAQ

Got Questions?

Got Questions?

01/

What makes me different from typical candidates?

I don’t separate theory from execution. Every model, strategy, or system I build is designed with deployment, failure modes, and real capital impact in mind.

02/

What kind of results i have delivered?

I’ve generated verifiable PnL and alpha across multiple environments—ranging from high-frequency options strategies to macro-driven multi-asset systems—while maintaining strict risk controls (Sharpe/Sortino-focused, drawdown-aware).

03/

Am i more of a trader or an engineer?

Both. I design systems first—research pipelines, execution logic, and risk frameworks—then deploy them in live or semi-live environments. The goal isn’t trades; it’s repeatable edge.

04/

What problems do i like solving?

Hard ones—where incentives, data, and uncertainty collide. This includes market microstructure, volatility dynamics, AI model reliability, and scaling decision systems under noisy conditions.

05/

What am i actually work on?

I work at the intersection of quantitative trading, applied AI, and systems engineering—building strategies, models, and products that operate under real-world constraints like risk, latency, and scale.

01/

What makes me different from typical candidates?

I don’t separate theory from execution. Every model, strategy, or system I build is designed with deployment, failure modes, and real capital impact in mind.

02/

What kind of results i have delivered?

I’ve generated verifiable PnL and alpha across multiple environments—ranging from high-frequency options strategies to macro-driven multi-asset systems—while maintaining strict risk controls (Sharpe/Sortino-focused, drawdown-aware).

03/

Am i more of a trader or an engineer?

Both. I design systems first—research pipelines, execution logic, and risk frameworks—then deploy them in live or semi-live environments. The goal isn’t trades; it’s repeatable edge.

04/

What problems do i like solving?

Hard ones—where incentives, data, and uncertainty collide. This includes market microstructure, volatility dynamics, AI model reliability, and scaling decision systems under noisy conditions.

05/

What am i actually work on?

I work at the intersection of quantitative trading, applied AI, and systems engineering—building strategies, models, and products that operate under real-world constraints like risk, latency, and scale.

01/

What makes me different from typical candidates?

I don’t separate theory from execution. Every model, strategy, or system I build is designed with deployment, failure modes, and real capital impact in mind.

02/

What kind of results i have delivered?

I’ve generated verifiable PnL and alpha across multiple environments—ranging from high-frequency options strategies to macro-driven multi-asset systems—while maintaining strict risk controls (Sharpe/Sortino-focused, drawdown-aware).

03/

Am i more of a trader or an engineer?

Both. I design systems first—research pipelines, execution logic, and risk frameworks—then deploy them in live or semi-live environments. The goal isn’t trades; it’s repeatable edge.

04/

What problems do i like solving?

Hard ones—where incentives, data, and uncertainty collide. This includes market microstructure, volatility dynamics, AI model reliability, and scaling decision systems under noisy conditions.

05/

What am i actually work on?

I work at the intersection of quantitative trading, applied AI, and systems engineering—building strategies, models, and products that operate under real-world constraints like risk, latency, and scale.

{06} — Connect with me