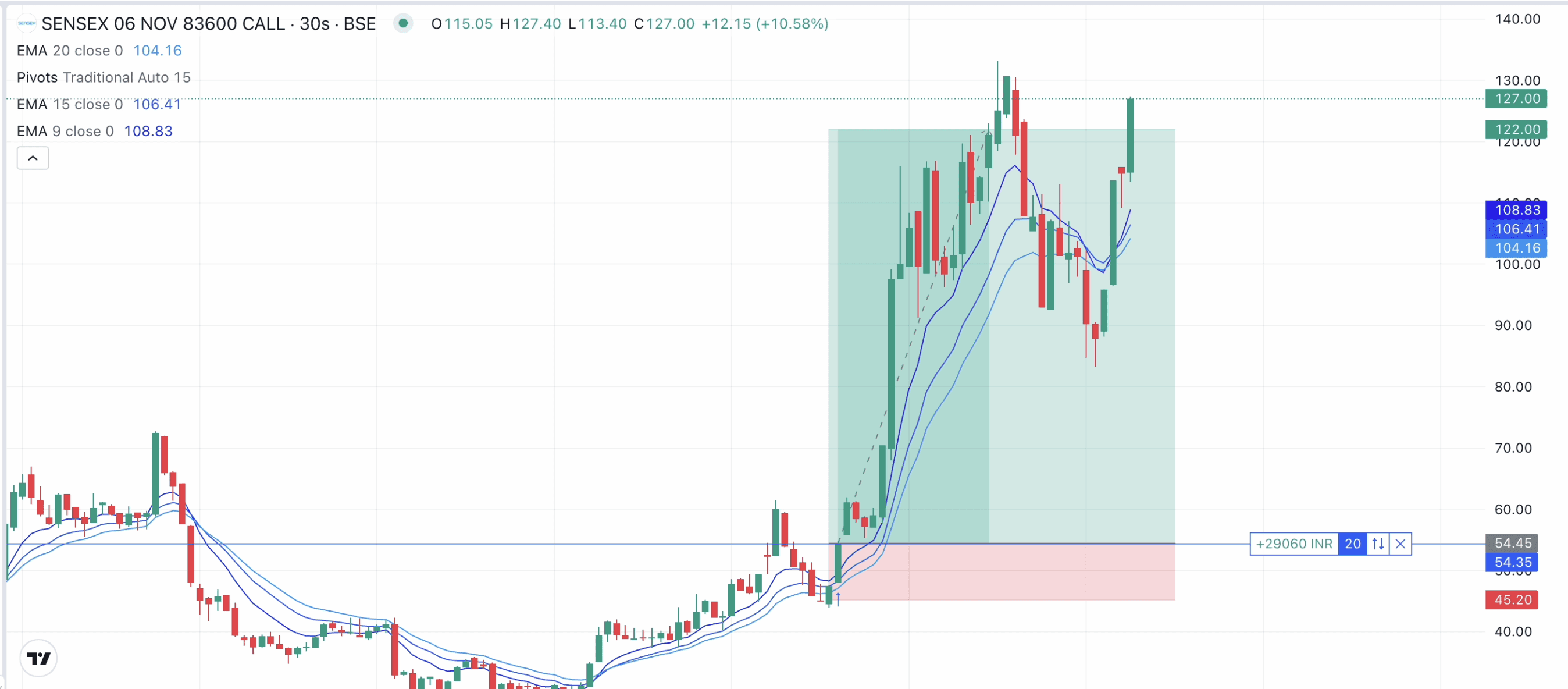

₹21K → ₹4.7L | 16 Trading Days | 88% Win Rate | Sortino > 4.0. Capitalizing on short-term volatility dislocations in Indian index options through structured gamma exposure.

Designed to extract asymmetric upside while maintaining strict control over downside risk and drawdowns.

Over a 16-day execution window, the strategy converted ₹21,000 into ₹4.7L in net alpha, achieving an 88% win rate and a Sortino Ratio above 4.0. While operating with a negative risk-reward profile inherent to options trading, downside was mitigated through strict position sizing, exit rules, and loss containment—prioritizing consistency and capital preservation over unchecked exposure.

This strategy focuses on identifying periods of rising implied and realized volatility in Indian indices, particularly during momentum-driven gamma squeezes. By positioning directionally with controlled exposure, the approach seeks to benefit from rapid price expansion while remaining responsive to changing market conditions. Trade selection is governed by volatility signals, liquidity conditions, and execution discipline rather than prediction-based bias.